The financial feasibility study (FFS) determines if or confirms that a project is potentially profitable, it including financial and scenario analysis and an investment appraisal. It should include a cost-benefit analysis of the project to cover the project's entire economic life, as most costs are incurred post-construction from operation of the facilities.

For hotel development projects, the findings are converted into a stream of revenue and expense until the end of the asset's economic life based on:

- Qualification of the local hotel demand and competitiveness of all existing and pipeline hotels in the market to estimate the annual occupancy rate (OCC) and the average daily rate (ADR) per room;

- A projection of the OCC and ADR to estimate the annual net operating income (NOI), commonly over a five- to ten-year period; and

- Conversion of the projected NOI using a weighted cost of capital (WACC) discounted cash flow procedure or net present value calculation to determine the internal rate of return (IRR).

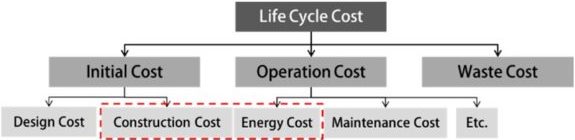

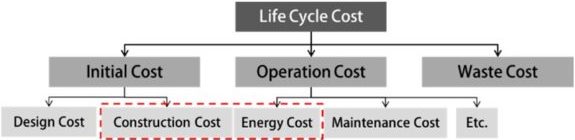

Life cycle cost analysis (LCCA) is used to identify the costs associated with a project in every step of development over its useful economic life, including disposal. LCCA takes into account the initial capital cost as well as operational, maintenance, repair, upgrade and perhaps demolition, landfill and/or recycling costs.

LLCA typically considers only the economic costs of a product, not social or environmental factors. It is commonly used by investors to determine a project's return on investment (ROI) until exit.

As used for sustainable development, whole-life costing is life-cycle cost analysis that considers the environmental, social and economic dimensions of sustainability in assessing the costs of an asset over its whole life. However, a universally accepted standard approach to value and calculate the costs of the social and environmental factors of sustainable development does not exist.