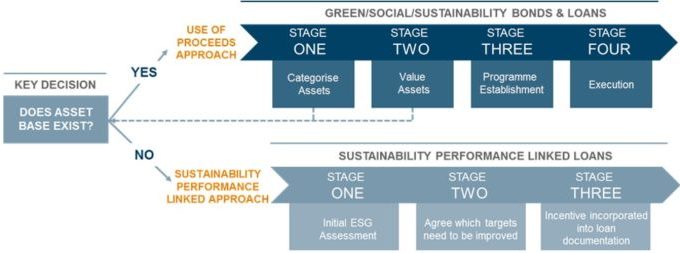

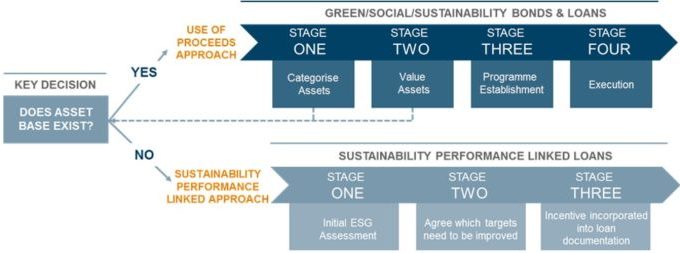

Green loan principles (GLP) provide a finance industry standard for borrowers to apply in their business with the objective of improving their sustainability performance, complying with environmental regulations, or ensuring long-term financial and operational stability. They also allow lenders to provide environmentally and socially responsible financing.

Green loan principles are based on green bond principles (GBPs). GBPs are internationally recognized voluntary guidelines for the issuance of bonds that promote transparency, disclosure and reporting in the green bond market.

Sustainability linked loan principles (SLLPs) set an international standard for determining how financing can facilitate positive corporate performance and achieve measurable growth in financing for sustainable development. Most loan documentation requires environmental, social and governance (ESG) compliance as part of borrower obligation to meet the general legal requirements.

Sustainability linked loans (SLLs) promote sustainable development by inducing borrowers to achieve ambitious, predetermined sustainable performance targets. By directly linking the financial terms of loans to sustainable performance targets, borrowers are encouraged to improve their sustainable development management.

The borrower’s sustainability performance is measured against sustainability performance targets (SPTs) as set against key performance indicators, external ratings, and/or equivalent metrics to measure improvement in the borrower’s sustainability profile. They are the environmental, social and governance (ESG) metrics that help identify assets and portfolios that adopt sustainability principles.

Green bonds and green loans aim to facilitate and support environmentally sustainable activity through the financing of green projects. The use of sustainability linked loans is not restricted to green purposes.