Traditional crowdlending is transacted over three-party P2P platforms that attract the interest of lenders and borrowers, act as an intermediary between the parties, administer the transactions, and perform payment collection in return for a fee. Four-party P2P platforms involve a borrower, a lender, the platform and a third-party loan originator in the lending process that makes loans available from outside the platform.

The client segregated model is used by three-party platforms that match lenders with borrowers with the funds and loan repayments flowing through client accounts that are kept strictly separate (segregated) from the platform's own accounts. The platforms serve solely as an intermediary between borrowers and lenders and charge the transacting parties fees for account setup, loan origination and loan administration.

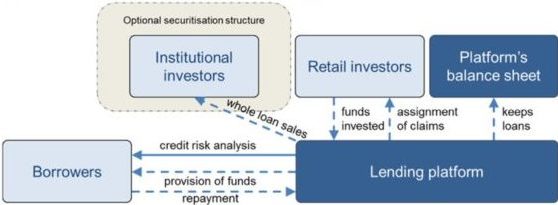

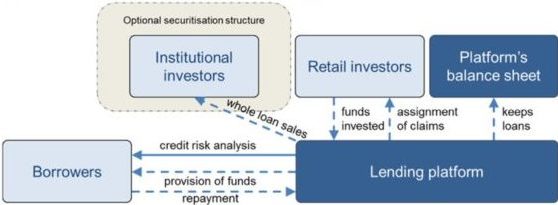

The balance sheet model is used by three-party platforms that originate loans for their own account that they then sell to investors to fund the loan. The loan default risk remains with the platform until the loans are sold or otherwise transferred. The platforms obtain the funds from the investors to lend to borrowers, who repay their loans to the platform. To fund loan origination, these platforms rely on wholesale funding sources, such as whole loan sales and securitization, instead of the "crowd".

The notary model is used by four-party platforms, where the platforms act only as a broker to match the loans originated by a partnering bank to the lenders. The originating banks sell or assign the loans to the investors, thereby also transferring to them the default risk. The loans may be sold either directly in smaller packages or to a platform subsidiary that repackages them into multiple loans. US online "notary" platforms use this model to issue notes that qualify as securities, making them subject to US securities regulation as an investment activity – therefore, it is also called "marketplace lending".