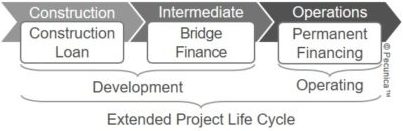

An acquisition, development and construction loan (ADC) is financing for the development of commercial real estate that is made available during a project’s construction phase. It allows a property developer to buy land, install the infrastructure, and build improvements.

ADC financing is commonly progress payment financing, where payments are made to a property developer to cover the cost of materials and the property's construction while it is being developed. The principal amount is advanced in progress payments and generally applied to the permanent financing.

Bridge financing is short-term financing with a bullet maturity that allows newly constructed or acquired commercial properties to reach stabilization and to pay off the construction loans until permanent financing can be obtained. Bridge financing is frequently provided by private equity investors for the acquisition of property and is subordinated to permanent financing, which is the source of its repayment.

Permanent financing is long-term commercial real estate financing that is used to finance acquisition of stabilized properties, refinance construction, bridge loans or other financing, commonly with a maturity of 30 years and longer. Permanent financing is provided by the construction lender and other types of lenders, including life insurance companies, pension funds, private debt funds, private equity debt funds, and conduits that issue securitize commercial mortgages.

A construction lender often requires a take-out commitment from a permanent lender. The permanent lender contractually commits to provide permanent financing to complement or replace the construction financing when a certain event occurs, generally upon stabilization and project construction completion.

Stabilization is when a development project or acquisition achieves a certain level of completion, lease-up and/or net income to enable either its sale or qualification for permanent financing. A take-out assures lenders that permanent financing will be available to repay the construction loan when the project is completed and other conditions are met.