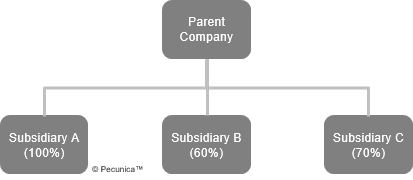

A parent company is a business entity that owns or controls one or more other companies, typically through the ownership of 50% or more of the voting rights in the companies. A company that is controlled by another company, generally through the ownership of more than 50% of its voting rights, is a subsidiary.

A parent or a subsidiary of the parent is an affiliated company, which are presented together as one entity in the consolidated financial statements of the parent company. A parent-subsidiary relationship exists when an entity has the power to govern the financial and operating policies of another enterprise in order to obtain benefits from its activities.

Together, a parent company and its subsidiaries are a company group. The definition of a “Subsidiary” in loan agreements determines the definition of “Group”, which, in turn, is used in determining which companies are caught by many of the provisions of the agreement.

| Affiliated Companies/Company Group |

Source:

|

Significant influence is the power to participate in the financial and operating policies of an investee, but is not control over the investee. Where a company holds 20% or more of the voting rights of an investee in which it does not have a controlling financial interest, there is a “rebuttable presumption” of significant influence.

An entity over which an investor has significant influence, generally through control of more than 20% and less than 50% of the company’s voting rights, but which is neither a subsidiary nor a joint venture of the investor is referred to as an equity-method investee under US GAAP and an associate under IFRS. A direct or indirect investment of more than 20% of the voting rights of a company should enable an investor to have significant influence over the operating and financial decisions of the company.

| Application of Uniform Accounting Policies within a Group | |

| US GAAP | IFRS |

| Application of uniform accounting policies within a company group is not required for consolidation. | Consistent, uniform accounting policies are used throughout a company group for consolidation. |

Leave A Comment

You must be logged in to post a comment.