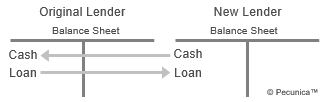

A loan sale is the transfer of the ownership and control rights of a loan from the seller to the buyer without recourse, guarantee, insurance or other credit enhancement, with the amount sold moved from the seller’s to the buyer’s balance sheet. The sale of a loan converts a long-term asset on the balance sheet into cash, thus reducing the maturity and increasing the liquidity of the assets. Loan sales are effected either by means of assignment or novation and may involve performing loans or nonperforming loans (NPLs) of distressed firms.

| Loan Sale Impact on Balance Sheets |

Source:

|

A true sale is the outright, irrevocable nonrecourse sale of assets to a third party, whereby the assets and all their rights are irrevocably (absolutely) transferred from the seller to the buyer and legally separated from the assets of the originator. Where assets are transferred with the seller retaining the risks and reward of the assets and with recourse to seller, the transaction is a collateralized financing – not a true sale.

| 3 Key Reasons for Loan Sales by Banks |

| 1. Deal with legal and internal lending limits. |

| 2. Meet capital-adequacy requirements. |

| 3. Manage loan portfolios. |

Assignment is a loan sale in which a lender transfers to another party the rights to interest and principal (not any obligations) of a financing to another party for amounts already drawn down and owing to the lender. Only the benefit of an agreement may be assigned, with any commitment to provide funds to the borrower remaining with the existing lender. Therefore, assignment is suitable primarily for fully drawn term loans.

| Types of Loan Sales | ||

| Transfer of | ||

| Rights | Obligations | |

| Assignment | ✓ | – |

| Novation | ✓ | ✓ |

Novation is a loan sale in which a lender transfers to another lender the rights and obligations of a financing in which the lender’s commitment to advance funds still exists. The buyer assumes the rights and obligations of the seller, becomes party to the contract and enters into a direct relationship with the parties to the agreement. Novation is suitable for the sale of undrawn term loans and revolving credit facilities prior to the end of their drawdown period.

Ringfencing is the segregation of poorly performing (“toxic”) assets from other bank assets to free banks from the distraction and use of resources required to manage a portfolio of distressed loans (the “good-bank/bad-bank” scenario). Some countries have established a government-sponsored bad bank to which distressed financial institutions transfer their NPLs and other troubled loans.

| 3 Forms of Distressed Loan Sales by Banks |

| 1. Bulk sales to targeted groups or to the open market. |

| 2. Individual loan or loan portfolio sales using online distribution channels. |

| 3. Sales to the borrowers or related parties. |

Leave A Comment

You must be logged in to post a comment.