The first-lien mortgage is the senior-most loan secured by real estate having priority claim against the real property. It is first in the chronological order in which all mortgage loans secure by the property are filed and recorded and payment upon the property’s disposition. The senior mortgage has priority over all junior encumbrances and gives its holder priority to foreclosure proceeds in the event of borrower default.

A sponsor may take out a second-lien mortgage on a property where a greater total loan amount is desired and to increase leverage. A second-lien mortgage is secured directly by the property it is financing but subordinate to the first-lien mortgage.

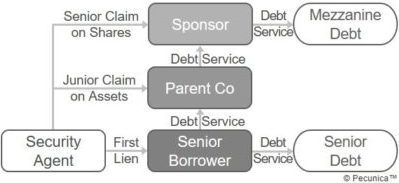

Real estate sponsors frequently increase their leverage in property through the use of mezzanine debt. In real estate finance, a mezzanine loan is debt financing common in acquisition (investment) financing that is junior to the mortgage loans but senior to sponsor and preferred equity and with a senior interest in the pledged sponsor equity.

Amounts owing to mezzanine lenders are typically contractually subordinated in a subordination agreement or intercreditor agreement to all principal and interest owing to senior lenders. They are also structurally subordinated when mezzanine debt is advanced to the parent company and then downstreamed to a subsidiary that is a senior loan borrower.

An intercreditor agreement (ICA) regulates the respective rights and ranking of creditors throughout the term of a financing, especially upon default. Where two or more lenders have a lien on the same collateral of various categories, their relative priority will be different for each category.

Under an ICA, a revolving credit lender typically has the priority security interest in working capital assets, a term lender the priority claim to machinery and equipment, and a mortgage lender the priority interest in real estate. An intercreditor agreement could assign to each lender a junior interest in the others’ collateral.