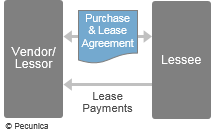

Leasing is frequently provided directly through the supplier of the leased equipment. Direct leasing is a two-party transaction that involves an equipment supplier (manufacturer or dealer) and the asset’s user (lessee), whereby the equipment is produced or purchased by the supplier and then leased directly to the customer by the supplier, either as an operating or finance lease. For direct leasing, a single contract is used by the lessor for both the equipment’s acquisition for the customer and the supplier’s lease of the asset to the customer, it comprising both the purchase contract and the leasing contract between the supplier and the customer/lessee.

| Direct Leasing |

Source:

|

The lessor of leased equipment is commonly also the supplier of the asset. A sales-type lease is a finance lease in which the sale of the lease of equipment is effected by the supplier (manufacturer, dealer or retailer) in one transaction using one contract comprising both a purchase and a lease agreement. The supplier of the asset in a sales-type lease realizes a gain or loss on the equipment’s outright sale at lease inception as well as interest income over the lease term equal to the present value of the minimum lease payments.

As with a regular sales transaction, the gross profit or loss realized by the supplier/lessor on the sale of equipment in a sale-type lease is the difference between the sales revenue on the transaction and the cost of goods sold (COGS). The gain or loss results from the cost of goods sold being lower or higher, respectively, than the leased asset’s fair value at lease inception and is recognized in accordance with the policy followed by the supplier for outright sales.

| Lessor Recognition of a Sales-Type Lease – Gross Method | ||||

|---|---|---|---|---|

| Date | Lease Receivable (Gross Investment) | xxxx | ||

| GOGS (CV + IDC - PV(UGR)) | xxxx | |||

| Asset (Cost or Carrying Value) | xxxx | |||

| Sales (PV(MLP to Lessor)) | xxxx | |||

| Unearned Interest Income | xxxx | |||

| Accumulated Depreciation – Leased Asset | xxxx | |||

| To record a finance lease at inception | ||||

The sales revenue equals the present value of the minimum lease payments discounted at the implicit interest rate, while cost of goods sold is usually recorded at the assigned inventory cost. Whereas the present value of any guaranteed residual value is included in sales revenue, unguaranteed residual value reduces both sales revenue and COGS by its present value to recognize the fact that the lessor will receive the residual value at the end of the lease term.

Leave A Comment

You must be logged in to post a comment.