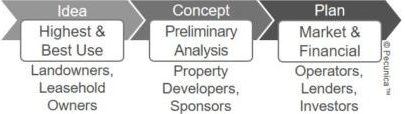

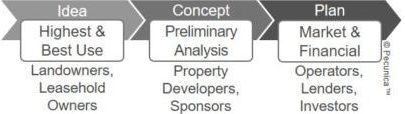

Developers conduct feasibility studies at the start of a project to determine its cost, justify the investment of resources, and establish the approach to maximize profit until project exit. Separate analyses are subsequently undertaken by lenders, operators and investors.

For the developer, a successful project is one that satisfies the developer’s explicit objectives. A feasible project is generally one with a projected economic value greater than its cost and that will produce the required return on investment (ROI).

Feasibility studies for hotel projects call for the evaluation of the demographic, geographic, economic, market and financial factors:

- Analysis of the area, demographic, and neighborhood to evaluate the local economy;

- Review of the site size, access and visibility, topography, availability of utilities and other site-related attributes;

- Review of the plans for the facility, the scope of the project, and the projected costs;

- Market analysis of the data gathered in the local and regional market;

- Estimate of project performance by projecting the occupancy rate (OCC), average daily rate (ADR), and revenue per available room (RevPAR);

- Estimate of the annual operating results by analyzing the project's scope and characteristics compared with comparable properties; and

- Calculation of the economic value through discounted cash flow or direct capitalization analysis.

They are typically performed by independent third-party consultants who specialize in hotel projects.

Feasibility studies are conducted for various project stakeholders, commonly with conflicting objectives and interests, for different purposes and with varying degree of detail at different stages of a property development project. For sustainable development, they must consider the interests of all stakeholders.