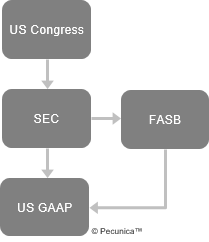

| US GAAP Relationships |

Source:

|

Most of the generally accepted accounting principles in the United States were developed after the stock market crash of 1929, in order to have financial reporting serve the needs of investors, lenders, and other interested parties. US federal securities laws require publicly traded companies to follow GAAP to ensure that the financial information they report is reliable and consistent in form with the financial reports of all other publicly traded companies. Although all publicly traded companies are required to follow these common standards and requirements, such matters as the statements’ names, the accounts within the statements and the manner in which the numbers are calculated are left to the companies’ discretion.