ESG Toolkit for Fund Managers

Environmental and social (E&S) risks are the potential negative consequences to a business that result from its (perceived) impacts on the natural environment or communities. Failure to effectively manage E&S issues in a business can lead to a range of financial, legal and reputational consequences for the com ...

Posted on 13/01/22

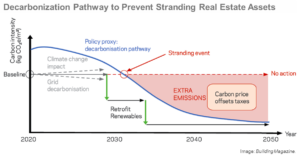

Are Stranded Assets an Unexploded Bomb?

Buildings that are too uneconomical to retrofit to comply with legislation, such as the EU Energy Efficiency Directive (EED) and National Energy and Climate Plans, become stranded assets. They are a significant risk for investors and property owners that have not ensured that their real estate assets are future-proofe ...

Posted on 10/01/22

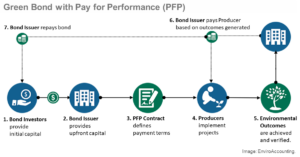

Green Loan Principles

Green loan principles (GLP) are a high-level framework of market standards and guidelines to promote the development and integrity of the green loan product. They define green loans as any debt instrument, including bonds, made available exclusively to finance or re-finance, in whole or in part, new and/or existing el ...

Posted on 10/01/22

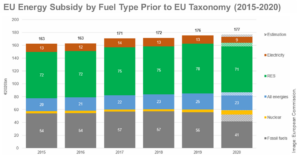

EU to Gut the Principle of Sustainable Taxonomy with Inclusion of Nuclear and Gas

EU taxonomy was intended to provide a system for the classification of environmentally and financially sustainable economic activities. It is essentially a green label for the investment of over a trillion euros. Also called the "Sustainable Finance Taxonomy", it's about subsidized financing and lots of money. The t ...

Posted on 07/01/22

Climate Change and Sustainability Disputes between Foreign Investors and States

Countries are transitioning to low carbon, sustainable and climate-resilient economies. The action taken by states on climate change and sustainability will affect the profitability and viability of many existing investments and commercial arrangements. Significant changes to the investment environment in the name of ...

Posted on 05/01/22

Postings2025-01-08T09:00:41+02:00